Use a Comparison Site

Use a Comparison Site

By using a travel insurance comparison site like Yonder, you won’t find the same product for a lower price anywhere. That’s because we work with the top travel insurance providers and allow you to compare policies side-by-side. Our relationships with these insurance companies allow you to find the most comprehensive travel insurance plans out there at the most affordable price. Still skeptical? Try out our instant quote tool and see for yourself!

Run an Instant Quote

Run an Instant Quote

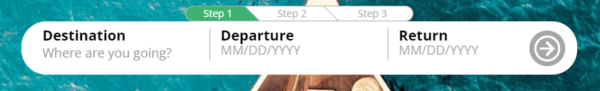

Now that you know where to find your travel insurance policy, the next step is to start searching for the best one based on the way you travel. On Yonder’s site, we have a free tool that collects the following information to provide an accurate estimate.

Step 1

Destination: List the location you’ll be spending the most duration in, even if you plan on traveling to other places. Don’t worry –you’ll still have coverage for your entire trip!

Travel Dates: Use the dates you depart from home and the date you’ll return to your home residence. This insures the entire time you’ll be traveling will be covered.

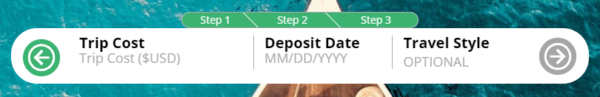

Step 2

State of Residence: This is where you currently live in the United States. If you are a non-U.S. resident, the estimate process is a bit more manual since the providers require travel to originate from the U.S. No worries though –we can still provide you with a quote!

Current Age: This will be the age you are as of today, not the age you’ll be when you travel. Remember that if all travelers are from the same state, they can be insured under the same policy for the same trip.

Step 3

Total Trip Cost: Many people are at a loss of what to put here. This amount should include any nonrefundable, prepaid deposits or payments you’ve made towards the trip you would like insured under Trip Cancellation. You can find out how to calculate your total trip cost so you’re protecting your trip accurately.

Trip Deposit Date: This is important to know for time-sensitive benefits like Pre-Existing Condition Waivers and Cancel For Any Reason upgrades. When putting down a date in the quote tool, be sure to use the very first date you made a payment or deposit towards the trip. Pro Tip: In the event of a claim, the insurance company will need documentation of your first payment, so double-check this date is accurate or your coverage might not apply for those upgrades.

Travel Style: Although optional, choosing a travel style can help filter your policy results page with appropriate benefits, ensuring you’re getting the right type of coverage. Plus, Yonder is the only place you can purchase policies unique to your travel style!

Once this information is entered into the quote process, our website will begin loading some travel insurance policies for you!

Compare Options

Compare Options

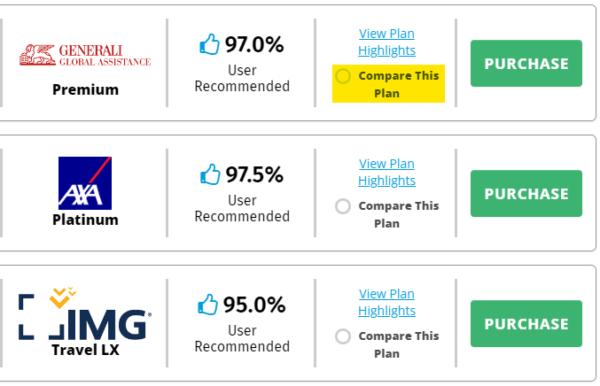

At this point, you should be looking at a policy results page with several choices from the top travel insurance companies. It’s helpful to ask yourself what type of travel concerns you have since that will dictate which type of coverage might be most important to you. There are a few features that might help you select the best policy such as:

View Plan Highlights: Clicking this will open up more information about that individual travel insurance policy. For instance, it will show you the coverage categories as well as coverage amounts included.

Pro Tip: We encourage you to read the fine print of the policies you have your eye on. You can find this within the “View Plan Highlights” window near the top left where it says “Certificate”. Clicking this will download the full policy description that explains exactly what’s covered and not covered.

Compare This Plan: This button allows you to compare multiple policies side-by-side, which we think can be one of the most powerful resources in selecting the best policy.

Use Filters: These were intended to be useful if you’re looking for a specific type of coverage. For example, Cancel For Any Reason, Pre-Existing Condition Waiver, and Cancel for Work Reasons coverage. Using too many filters might have an adverse affect though, so don’t get too click happy! Pro Tip: Our team loves to use the “Price (Low to High)” filter to make sure you’re getting the most comprehensive coverage at the most affordable price when you buy travel insurance.

Send a Quote to Yourself

Send a Quote to Yourself

If you don’t have enough time right there and then to compare, that’s completely fine. We’ve made it easy for you to come back to your quote at another date by using the “Email Quote” green button at the top of the policy results page. All you’ll need to enter is your email address to send the estimate right to your inbox.

Ask an Expert

Ask an Expert

If you’re feeling a little overwhelmed by the options or just not quite sure which policy to purchase, our team of friendly humans would love to help you! Our team is available by email at [email protected] or by phone at 855-358-6433 8:30am-5pm CST, Monday through Friday.

Purchase

Purchase

Once you feel comfortable with a particular travel insurance plan, insure your trip by purchasing! All you’ll need to do is click on the big “Purchase” button to go to the checkout page. From there, some basic contact information will be collected in case of a claim as well as your payment information to seal the deal.

Once you’ve purchased your travel insurance policy, read up on these next steps to make sure you have everything you need for your trip to go as smoothly as possible.

Many people feel instant peace once they know their trip is insured should something come up and botch their travel plans. We hope that’s the case for you too! Find out what other steps you should take after you buy travel insurance to keep your trip fully covered.

As a seasoned professional with over five years of experience in the travel insurance industry, Meagan has honed her expertise in marketing and operations working for Yonder Travel Insurance.

Throughout her career, she's shown dedication assisting customers at every stage of their travel insurance journey, from the initial quote process to navigating the claims process. Her expert understanding of travel insurance equips her to provide unbiased and valuable insights, which help travelers find the best coverage and maximize its benefits.

Use a Comparison Site

Use a Comparison Site